Social Security Benefit Withholding 2025. You can ask us to withhold federal taxes from your social security benefit payment when you first apply. Refer to what's new in publication 15 for the current wage limit for social security wages.

Yes, there is a limit to how much you can receive in social security benefits. Up to 50% of your social security benefits are taxable if:

Submit a request to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png)

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any. Social security payments are also subject to state income.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes on Earnings After Full Retirement Age, There's no wage base limit for medicare. If you are already receiving benefits or if you want to change or stop your.

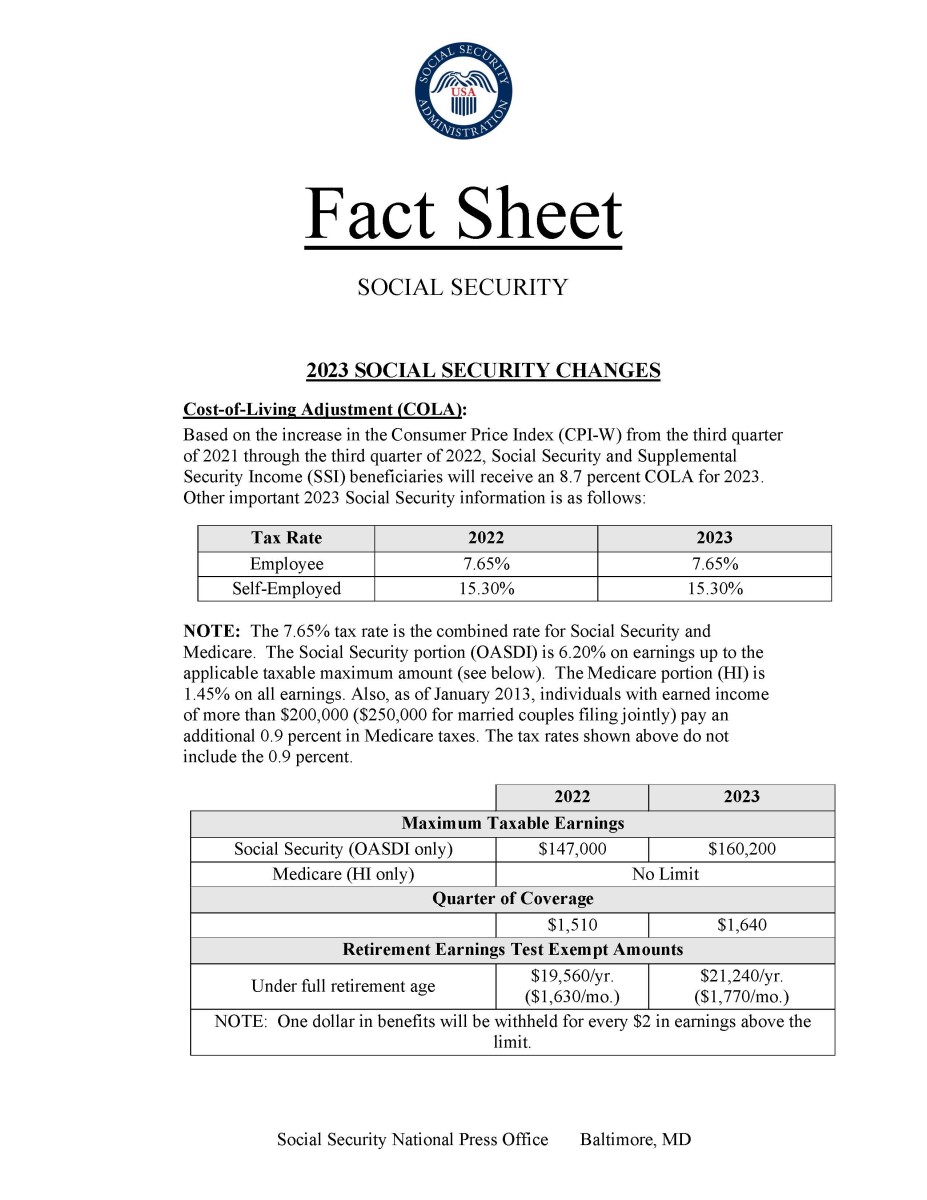

How To Calculate, Find Social Security Tax Withholding Social, We call this annual limit the contribution and benefit base. More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security.

How to get an Apostille for a Social Security Benefit Verification, For earnings in 2025, this base is $168,600. Social security payments are also subject to state income.

Social Security Announces 8.7 Benefit Increase for 2025 Retirement, The maximum social security benefit changes each year. More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security.

Max Social Security For 2025 Dodi Nadeen, Social security payments are subject to federal income tax in 2025, but only if combined income exceeds certain limits. You can ask us to withhold federal taxes from your social security benefit payment when you first apply.

How a Social Security Benefit Is Figured For Beginners and for, More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security. For earnings in 2025, this base is $168,600.

Social Security Retirement Benefit Basics Kirtland Credit Union, Submit a request to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time. The irs reminds taxpayers receiving social security benefits that they may have to pay federal income.

Social Security Statistics (2025) Retirement Living, You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any. There's no wage base limit for medicare.

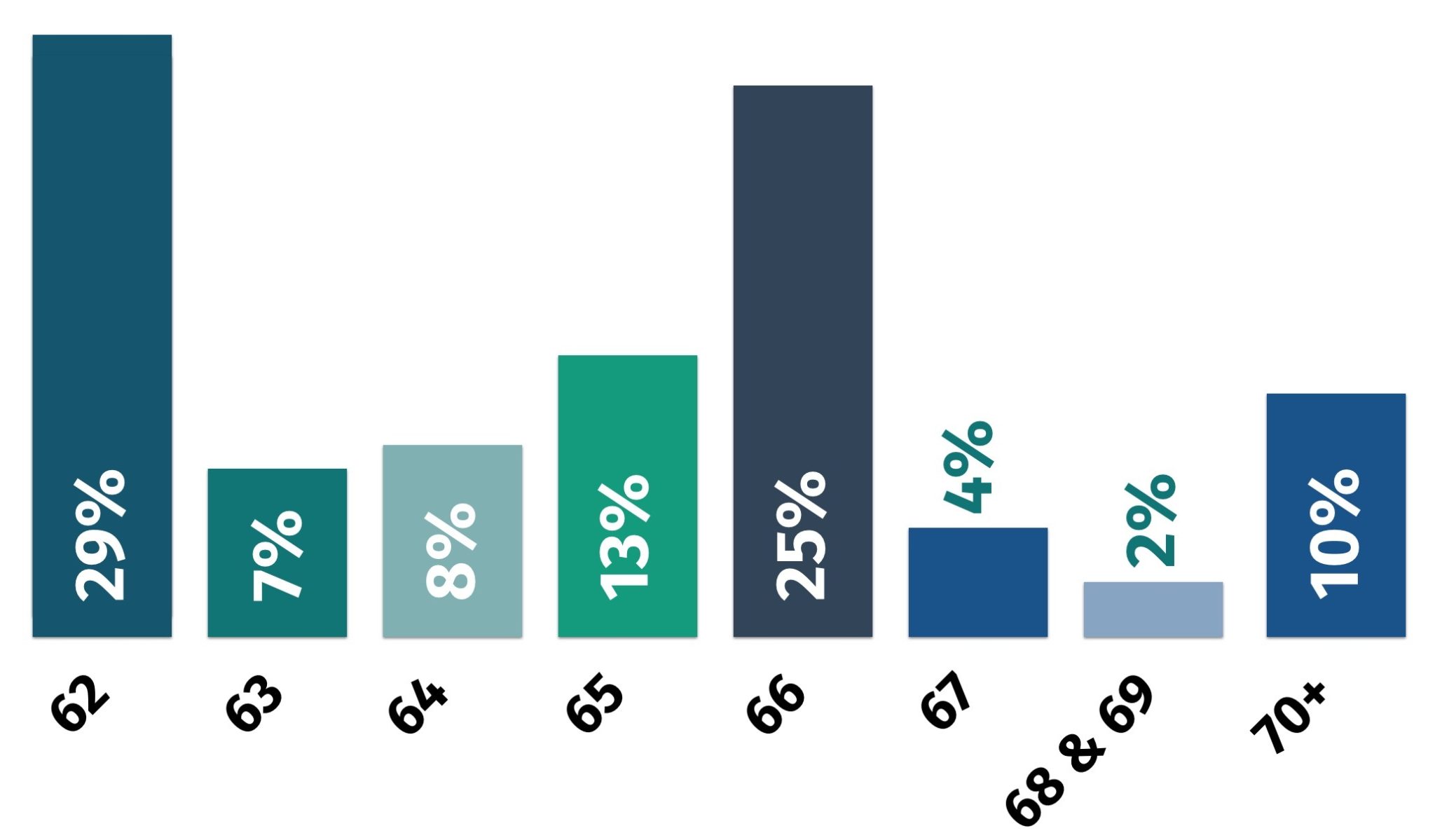

Should You File Early for Social Security? Acadium Financial Partners, See what you might receive. Social security payments are subject to federal income tax in 2025, but only if combined income exceeds certain limits.