401 K Irs Limits 2025. For those under age 50, the contribution limits are $22,500 for a 401(k), $6,500 for an ira and $3,850 (for solo coverage) or $7,750 (for family coverage) for an hsa. Each year, the irs places limits on the maximum amount participants can contribute to their 401(k) plans.

Each year, the irs places limits on the maximum amount participants can contribute to their 401(k) plans. Starting in 2025, employees can contribute up to $23,000 into their 401 (k), 403.

Each year, the irs places limits on the maximum amount participants can contribute to their 401(k) plans.

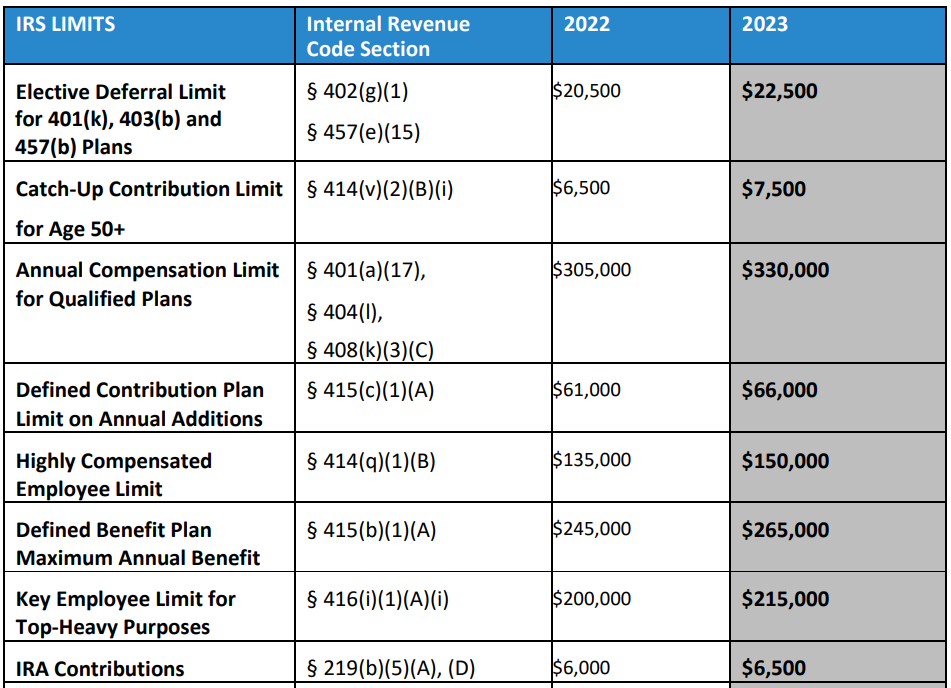

The IRS just announced the 2025 401(k) and IRA contribution limits, The 2025 contribution limits for 401(k), 403(b), and most 457 plans have been raised, increasing by $500 the amount plan participants can contribute. Starting in 2025, employees can contribute up to $23,000 into their 401 (k), 403.

401k Limits In 2025 Elana Virginia, The 401 (k) contribution limit is set by the irs and has been set to $23,000 for 2025. For 2025, you can contribute up to $22,500 to your 401 (k).

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, The contribution limit for 401 (k), 403 (b), thrift savings plans and most 457 plans will be $23,000 in 2025, rising from $22,500 in 2025. Three reasons a roth ira isn't better than a roth 401 (k) here are a few drawbacks of the roth ira that are worth keeping in mind as well:

401(k) Contribution Limits in 2025 Meld Financial, 2025 401(k) and 403(b) employee contribution limit. When it comes to individual 401(k) contribution limits, it helps to separate the limits that apply to you as an employee and yourself as the employer.

The Maximum 401(k) Contribution Limit For 2025, 2025 401(k) and 403(b) employee contribution limit. You can possibly save more for retirement in 2025, thanks to recent irs changes to employee contribution limits for 401 (k), 403 (b), and most 457 plans.

2025 IRS 401k IRA Contribution Limits Darrow Wealth Management, 401 (k) and roth contribution limits: When it comes to individual 401(k) contribution limits, it helps to separate the limits that apply to you as an employee and yourself as the employer.

401K Limits 2025 Stefa Emmalynn, 401(k) pretax limit increases to $23,000 the dollar limitations for retirement plans and certain other dollar limitations. The contribution limit for 401 (k)s, 403 (b)s, most 457 plans and the federal government's thrift savings plan is $23,000 for.

401(k) Contribution Limits for 2025, 2025, and Prior Years, Until then, here are the limits for 2025 retirement plan contributions, as verified by the irs. The 2025 contribution limits for 401(k), 403(b), and most 457 plans have been raised, increasing by $500 the amount plan participants can contribute.

401(k) 2025 Contribution Limits When are the limits adjusted? Marca, Irs releases the qualified retirement plan limitations for 2025: Employees will be able to sock away more money into their 401 (k)s next year.

What Are the Retirement Plan Dollar Limits for 2025? Lexology, The 2025 401 (k) contribution limit. The contribution limit for 401 (k)s, 403 (b)s, most 457 plans and the federal government's thrift savings plan is $23,000 for.